The influence of the reimbursement act on the Polish pharmaceutical market

-

Copyright

© 2013 PRO MEDICINA Foundation, Published by PRO MEDICINA Foundation

User License

The journal provides published content under the terms of the Creative Commons 4.0 Attribution-International Non-Commercial Use (CC BY-NC 4.0) license.

Authors

| Name | Affiliation | |

|---|---|---|

Wojciech Giermaziak |

Home Medical Library, Poland |

On 12th May 2011, the Act on Reimbursement of Medicines, Foodstuffs Intended for Particular Nutritional Purposes and Medical Devices was introduced to the Polish healthcare system. After one year of the Act being operational, the government concluded that the bill was bringing certain benefits to the taxpayer by, sometimes, drastic cuts in the immediate profits of producers, importers and retail and wholesale businesses, both in private and public healthcare. Simultaneously with government actions, various analyses are underway from the private sector initiative (including, among other, IMS Health Poland, Pharma Expert, Kamsoft, WHO, and some European law firms).

The implemented changes in the pricing process of medicinal and medical products (a flexible system of price setting); an array of medications with identical/near identical profile into, so-called, limit groups and narrowing the scope of reimbursement to drugs, administered in compliance with their intended use, as well as the integration of the new legal provisions with the already existing regulations have brought substantial financial benefits to the taxpayer. Rationalisation of expenses, incurred by NFZ (the Healthcare Fund), was the primary goal of the Reimbursement Act, while extending the scope for the use of medication particles, as well as of the latest medical technologies, e.g., in new or modified medication programmes. The aim of this study was an analysis of the overall functioning and results of the Reimbursement Act after one year from its implementation.

The pharmaceutical market in Poland (2011)

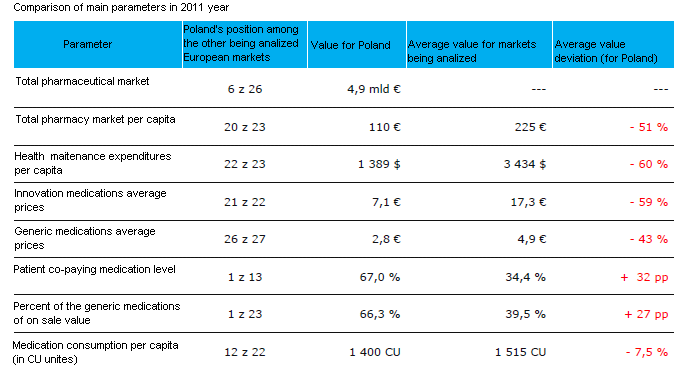

IMS Health Poland’s analysis, made on the basis of the elementary indicators characterising pharmaceutical markets in Europe, shows that Poland places far behind in the ranking. The applied parameters included: the total of the pharmaceutical market, average medication prices, reimbursement levels or medication consumption per capita, see Table 1 for a detailed presentation [1]. It should be emphasised that the values encompass the year 2011, hence before the implementation of the Reimbursement Act in January 2012.

Table 1. Comparison indicators [1]

The Reimbursement Act: premises, interested parties and proposals to change the legsilation

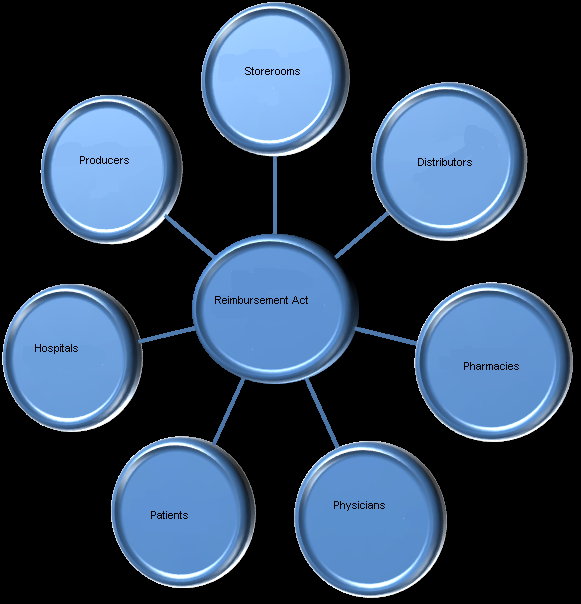

The Act of May 12, 2011, on Reimbursement of Medicines, Foodstuffs Intended for Particular Nutritional Purposes and Medical Devices was amended by the Act of January 13, 2012 on Reimbursement of Medicines, Foodstuffs Intended for Particular Nutritional Purposes and Medical Devices (Journal of Laws of 2012, No 0 item 95), its main goal being to rationalize public expenses, while keeping capital dues, which should generate substantial savings for the state budget and a reduction of medication prices for patients. However, the chief goal of the new Act was to bring order to the market of reimbursed medications by ehanced availability of relatively new medications (the Polish market of reimbursed madications encompasses mainly generic products from domestic production and import) and an extending range of innovative Products. Following the Transparency Directive of the EU, the Act guarantees transparency and contributes to Poland's image of trustworthy, transparent European and world partner in business. The interested parties include all subjects of the pharmaceutical market in Poland (Figure 1, Pharma Expert, 2011).

Figure 1. Stakeholders

The major changes, brought by the Act to the pharmaceutical market, include:

- a certain stabilisation and more effective control of public expenses for the reimbursement of medications and medical products, which amount to 17 % of total funds allocated for guaranteed medical services;

- pay-backs when supply limits are exceeded;

- fixed prices (set by the Minister of Health after negotiations with involved parties or their proxies) and fixed wholesale margins for reimbursed medications;

- limit groups under a common financing limit. The limits are set as the highest price out of the lowest wholesale prices for a daily dose of a medication (Defined Daily Dose - DDD), which complements 15% of the monthly turnover of a given limit group;

- modified criteria to include medications on reimbursement lists, with a close association with medical product characteristics (supported by verified scientific evidence);

- the decision is made by the Secretary of State for Health after a recommendation from the Transparency Board, an opinion of President of The Agency for Health Technology Assessment (AOTM), the position of the Economic Commission and the clinical and practical importance of assessed product;

- announced publication of the list with reimbursed medications every two months, dynamically illustrating the reimubursement process in Poland;

- elimination of the, so-called, „faulty reimbursement”; So far, a non-reimbursed medication, equivalent to the substance on the reimbursement list and its price being lower than the limit price of the reimbursed medication, could be sold by pharmacy as a reimbursed product. Now, only the products, which are on the list of reimbursed medications, apply for refund;

- banned advertising. The Act, as the first among legal acts, dedicated to healthcare and the only one in the legislation today, has introduced a ban on discounts for medications, foods for special purposes and other medical products at all their distribution levels.

Pharmacy market

Throughout 2011, the pharmacy market was tightly consolidated – about 68 % of all the pharmacies were included in commercial chains or sales groups. The initial capital of chain pharmacies unequivocally reveals their financial associations and business relationships with the biggest wholesalers in Poland. The other pharmacies are in private hands, mostly of family businesses, demonstrating various purchasing structures. At the time of the Act implementation, there were 13,985 pharmacies on the Polish market (source: Central Statistical Office 2011). The value of the medications on sale at pharmacies reached the amount of PLN 22.3 billion.

The onset of negotiations on procedures, carried out by the Ministry of Health with involved parties, brought about a considerable panic on the market in December 2011, artifically heated up by the media and demonstrated by unrest at pharmacies and excessive buying. Doctors prescribed more drugs, especially for long-term medical conditions. as well as for popular medical products, e.g., sugar level assessment strips or dressing packages for long-term care. That enhanced trading at pharmacies considerably diminished their stock levels of medical products, sold against prescription, e.g., an average stock volume in Octobe 2011 was sufficient for 33 selling days, in November 2011, it was enough for 31 days, while in December 2011, the average stock volume was traded within 20 days only. This lower stock potentials in December 2011 and the observed small decreasing tendency in November 2011, could also have been dictated by conscious decisions of pharmacy owners to reduce stocks against the applicable tax policy.

The December rise of pharmacy retail sales caused a soaring increase in the value of reimbursed medications, more distinctive in analyses as the sales rates in January and February 2012 were much lower, probably also for the necessity to refill stocks and gradually return to turnover stability and serving the needs of patients. See Table 2 for a comparison of the pharmacy market values between the years 2010 and 2011.

Table 2. Comparison of the pharmacy market values between the years 2010 and 2011

| Before 1st January 2012 | After 1st January 2012 |

|

|

On the basis of the presented comparison it is difficult to draw unequivocal conclusion as to the vital influence of the results of the act treated as a becon of drastic changes in the system on the Polish pharmacy market.

A particularly important change is the total ban on advertising of the reimbursed medications, practically, at every trading level. This particular regulation has raised much controversy, stirring emotions among many groups of interest. A group of pharmacist trade unions, who used to lobby this solution, have been supporting its implementation as equalizing the positions of market players. On the other hand, manufacturing and trading businesses, which were before used to unconstrained advertising of medical products, perceive the Act as unconstitutional and damaging for their profits. The fragment in the Act on on banning the advertising is not specific as the Act does not forbid advertising materials to be displayed / exposed at the pharmacy. Morover, shop-window and outdoor advertising is a allowed, as long as it encourages the use of a given product but without any references to the price aspect. As far as the prices of medications are concerned, the Act obligates pharmacists to inform the public about the cheapest equivalents of reimbursed products available at other pharmacies.

The Act obligates the Minister to publish the lists of reimbursed medications every two months and support the Economic Commission to attain desired economic outcomes in negotiations with involved parties. The end effect is the influence of the publication of the reimbursed medications lists on the pharmacy market.

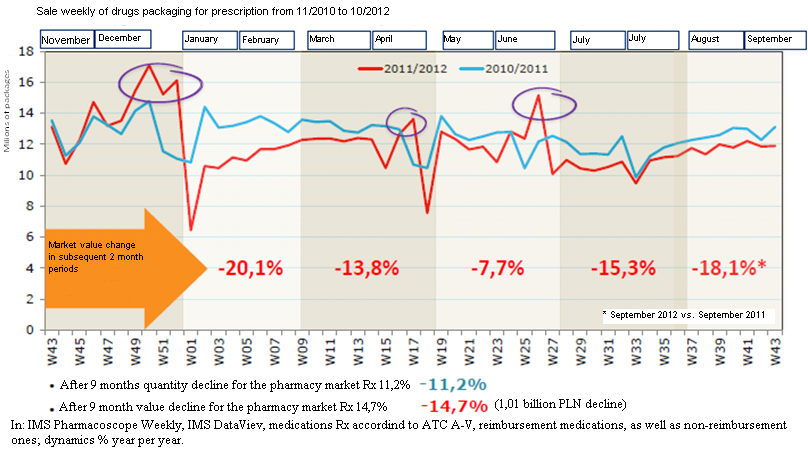

Figure 2. Weekly sale rates of prescribed medications from November 2010 to October 2012

The dynamics of the Polish pharmacy market, observed during the first half-year from the Act implementation is shown in Figure 2, Table 3. A decrease of reimbursement by approximately 1.6%, recorded during that half-year, was a noticeable observation, indicating the efficacy of the Act for the price normalisation trend, while shedding light on the scale of overestimating its benefits, especially as the major costs were still incurred by the taxpayer.

Table 3. Global pharmacy market January-July 2012 [2]

| Global pharmacy market | January – July 2012 | Change % |

| total turnover (in thousand PLN) | 15 000 123 | -3.7% |

| reimbursed prescribed drugs (in thousand PLN) | 5 558 362 | -19.9% |

| prescribed drugs for full price ( in thousand PLN) | 3 332 489 | 14.7 % |

| OTC (in thousand PLN) | 5 998 218 | 6.4 % |

| reimbursement amount (in thousand PLN) | 3 932 210 | -15.8 % |

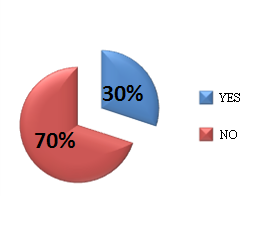

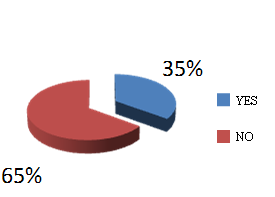

The Polish Pharmaceutical Chamber represents pharmacists in Poland and, as it has been mentioned above, it supported the legislation works on the Act, as well as assisten in its implementation. The crown argument raised by the pharmacists was the government’s proposal to introduce fixed prices and margin on reimbursed medications. Figure 3 demonstrates that approximately 50 % of pharmacists negatively evaluate the impact of the Act on the condition of pharmacies. These results generate a question about the real ownership structure of the pharmacies, while bringing up a real dilemma:vocation or commercialization!?

Figure 3. Pharmacists' perception of the new Reimbursement Act

According to the data, published by the Pharma Expert in the middle of 2012, the estimated predictions of the Polish pharmacy market assume the year 2012 to close with PLN 25.6 billion, i.e., with a decrease of approximately 4 to 6 % vs. the outcome of 2011 and, analogically, the reimbursement would fall by approximately 17 to 19 % vs. 2011 down to PLN 7.1 billion.

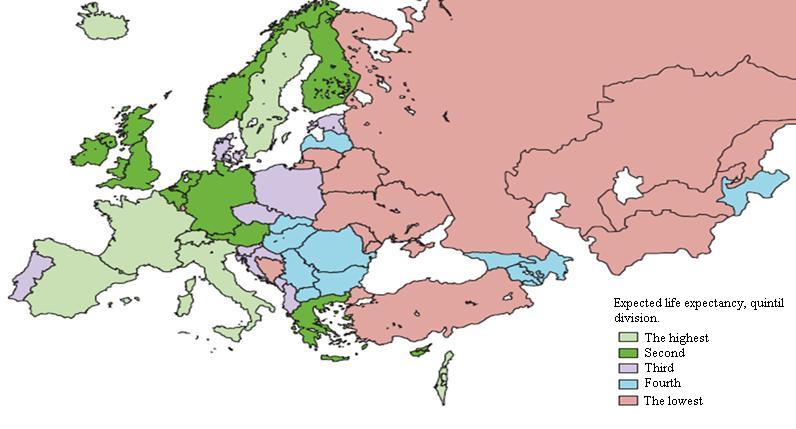

Before going to the question of patients and their situation after the implementation of the Act, I will present the health condition of the Polish society, based on a sample research by Prof. Johannes Siegrist from the Medical Faculty at the University of Dusseldorf, President of the WHO EURO Work and Employment Task Group. Life expectancy in the WHO’s European Region in 2010 is shown in Figure 4.

Figure 4. Life expectancy (In: M. Marmot et al. (2012), Lancet 380: 1011)

In this comparison, Poland ranks the third. Compared with other European countries, it is an average position. However, it may be a bit thought-provoking when social health determinants were analyse on the following three levels:

- the macrolevel: international determining factors, both economic and political: the results of economic growth and economic crisis, threats to the environment, and, most important, the observance of human rights in the context of healthcare inequalities;

- the domestic level: the influence of healthcare systems and social policies especially health inequalities and ineffective management systems – governments – e.g., performance of healthcare services;

- the level of life circumstances: a detailed analysis of scientific proof and commissions, regarding the early life stages and childhood, puberty, health-detrimental impacts in the middle age in the context of working life and older age, including age-related medical conditions, demanding treatment and care.

The first two periods, childhood and middle age, similarly to all the above-mentioned levels of health determinants, are in corelation with the use of medications, therapeutical systems, thus becoming a target of healthcare policy of the government.

Health, in its quality sense, according to the research the WHO EURO’s Task Group, carried out in middle-aged population shows that this age group is most prone to coronary disease (8 to 15 %), depression (20-25 %), physical unfitness of various aetiologies (approximately 10 %), overall self-admitted weak health condition (approx. 15 %).

The quoted research and evaluation figures constitute an observation of an average working-age group of the Polish society and should be the point of reference to patients' data vs. the results of the implementation of the Reimbursement Act.

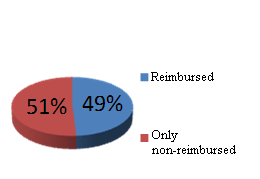

A reduced patient’s share in the cost of reimbursed medications was one of the objectives of the implemented Act. Data, as provided by research, performed by all market participants, constantly monitoring the Polish medications market, indicate a small increase of patient's share in the initial stage of the Act implementation, which was 34% in 2011, when „faulty reimbursement” was acceptable and patients had an unconstrained access to approximately 4400 reimbursed substances. In 2012, the reimbursed medication lists include 3061 substances and the level of co-payment was 34.9 % (out of that group, 2800 medications were already reimbursed in 2011), while 1600 medications, reimbursed in 2011, are now full-paid. The way of estimating patient's share in the payment for drugs, based on simple adding of the prices of fully-paid medication, which used to be reimbursed before, greatly increases the level of patient’s co-payment, which, by this estimation system, reaches 37.9 %, hence an increase by 4 %. This method of estimating the patient’s share is detrimental to the Act’s objectives, since the medications that did not find their way to reimbursed medications list should not be subject of arithmetic summation of the amount of patient's share, reached in negotiations, due to the fact that there still may be green light for their comeback to reimbursed medication lists, of course by meeting the requirements, specified in the Act and finding a positive approach of responsible subjects. Market arrangements and the time period of the Act being operative have brought about a systematic decrease in reimbursed medication prices, followed by continuous dynamic, qualitative and quantitative changes in published lists. Keeping that in mind and taking into account the growing tendency in the patient’s share in the costs of generic (39.6 %) and innovative medications (35.3 %), based on a wrong, in my opinion, premise, leads to a false conclusion that Poland demonstrates the highest level of patient’s share in the costs of reimbursed medications.

A much more dangerous phenomenon, which could be observed in the first year of the Act, was a continuous increase in the sales of reimbursed medications at full price. This phenomenon can be explained by the quality changes in the Regulation on prescriptions, whose implementation almost simultaneous with the reimbursement Act, brought much confusion in the doctors' prescription practices, a wave of protest from doctor groups against the Ragulation's provision to follow the guidelines of the Medicinal Product Characteristic. The outspoken worry of the doctor groups about possible consequences of wrongly drafted prescriptions supported the ongoing trend to prescribe fully-reimbursed medications.

The system of estimating the limit and recurring changes in the reimbursed medication lists, published every two months, brings a sense of destabilization, particularly in long-term patients. As the time goes by, this phenomenon is gradually disappearing because the prices of the medications are more and more stable, which also points to an overall stabilization on the reimbursed medications market. Another question is the problem of availability of the cheapest equivalents, which should constitute the basis for wholesale and retail trading. However, it is rather difficult to buy the cheapest equivalents in the retail system. The explenation of this phenomenon can be found in the financial policy of wholesalers and the financial relations between them and manufacturers, which can imply the availability of the cheapest reimbursed medications at pharmacies.

Distribution and wholesalers

In result of the Act implementation, a simplified scheme of medication distribution can be presented as follows: the producer/the responsible subject –pre-wholesale – wholesale – pharmacy – the patient. The Act has also introduced vital regulations, lowering wholesale margins and stabilising prices at retail level.

The reduced margins in the distribution chain have brought about urgent cost-cutting, including employment reduction, limited frequency of deliveries and reducing stocks, thus overall substantial changes in the distribution chain. The wholesale market is still a dynamically developing economic sphere, integrally associated with generated national economic outcome. After one year from the Act implementation, it is too early to draw conclusions about this particular sector of the pharmaceutical market. A full reduction of wholesale margin, what is in compliance with the provisions of the Reimbursement Act, and proposals of the Economic Commission may support a development of pharmaco-economic indicators to assist in a preliminary evaluation of the effects, which the new legislation has brought.

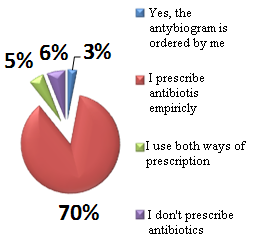

Doctors

Based on a phone survey, conducted by the Medycyna Praktyczna Journal between the 6th and the 7th September 2012, out of 200 doctors, participating in the survey by random selection, it is difficult to resist an impression of poor quality in prescribing of reimbursed medications (Table 4, Table 5). The only thing is to hope that this state of affairs will gradually normalize.

Table 4. Reimbursement drugs prescriptions behaviors of polish doctors

Table 5. Reimbursement drugs prescriptions behaviores of polish doctors

Conclusions

The Reimbursement Act has been the first Act to introduce such vital changes to the healthcare system. Discussing particular issues of the reimbursement system point by point, I have tried to show current effects of the Act. Analysing the economic results of the NFZ and the market pharmaceutical configuration in terms of pharmacological quality, availability and patient's shares in medication costs, it seems that certain amendments to the Act would be necessary, to correct its faults, perceived from the practical perspective of its implementation in the field of actual healthcare arrangements, with stabilisation and normalisation of the medication market in Poland to be its primary targets.

- IMS Health Polska –current comments and develop the Reimbursement Act, the specific source is placed in the text at a specific citation

- PharmaExpert – current comments and develop the Reimbursement Act, the specific source is placed in the text at a specific citation

- WHO Poland – data of Conference of European Review of Social Determinants of Health and Health Inequalities in Europe, Johannes Siegrist

- Polish Pharmaceutical Chamber (Naczelna Izba Aptekarska)